Indicators

Malmö City's objectives are monitored through the following indicators:

- Own visitor counters on Södra Förstadsgatan and Södergatan. Measured continuously, reports are available monthly.

- Survey on supply (sectors, price levels, market approach) conducted in 2014, 2018 and 2022.

- Reported annually in autumn for the previous year.

- The Malmö location. Tourism measured in guest nights. Reported annually in the autumn for the previous year.

- The Malmö Stad City Report survey conducted in 2018 and 2020 will be repeated in 2022 (mainly the questions: Malmö city centre is attractive to visit, Malmö city centre is well maintained, the design of the urban environment is attractive)

- Consumer survey in 2022, to be answered by both those who already visit the city centre and those who do not. The aim is to understand what attracts/what is missing in order to attract more and new target groups. The survey will be repeated after 3 years to see what changes have been achieved. This was carried out in autumn 2022 and presented in January 2023.

- Turnover Malmö City Gift Card

- Social media followers

- Number of members

- Number of users in Chainels

Outcome

Flow of visitors

Objective: Increase visitor flow based on 2019 figures and compare with the national average

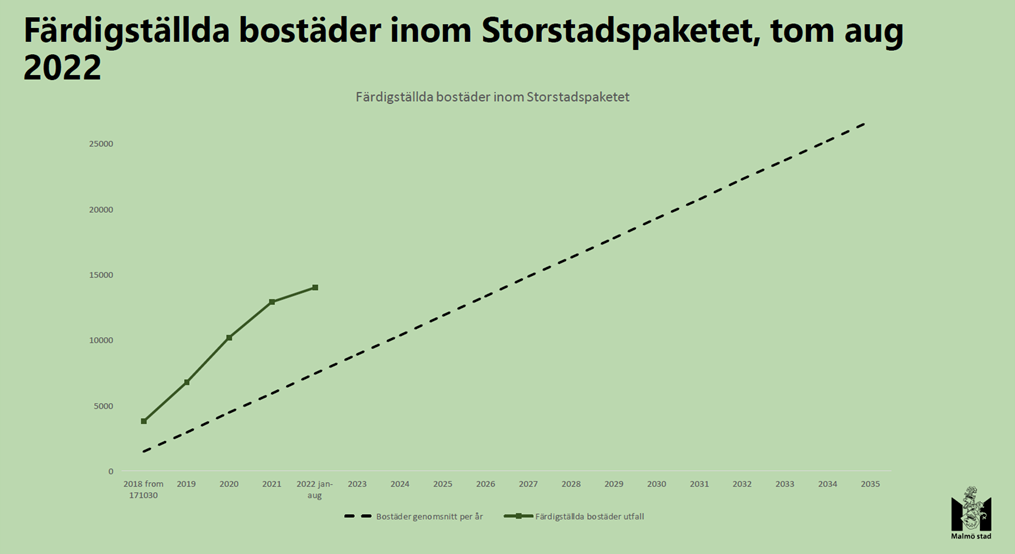

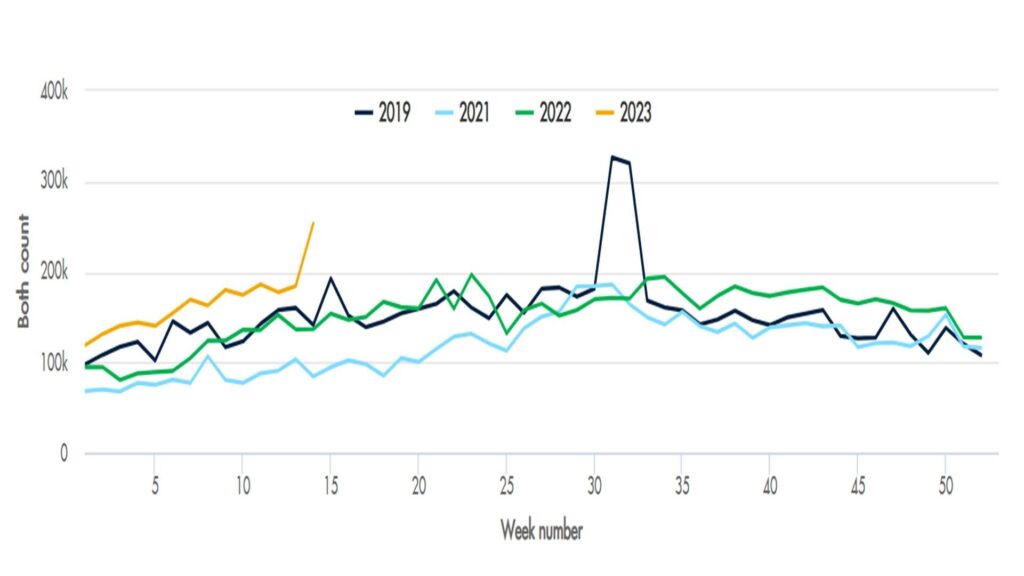

Our visitor counters show that the work is paying off. The graph below shows the weekly development of our main street Södergatan, which is the street with the highest visitor flows in Malmö City. The graph shows data since the last normal year 2019 until 2023, with the corona year 2020 removed. In the last six months, visits have been consistently above 2019 levels. So far this year +19.5 % (!) against 2019 figures, which can be compared with the national average of -16.1 %, for the cities that have the same visitor counting system as we have.

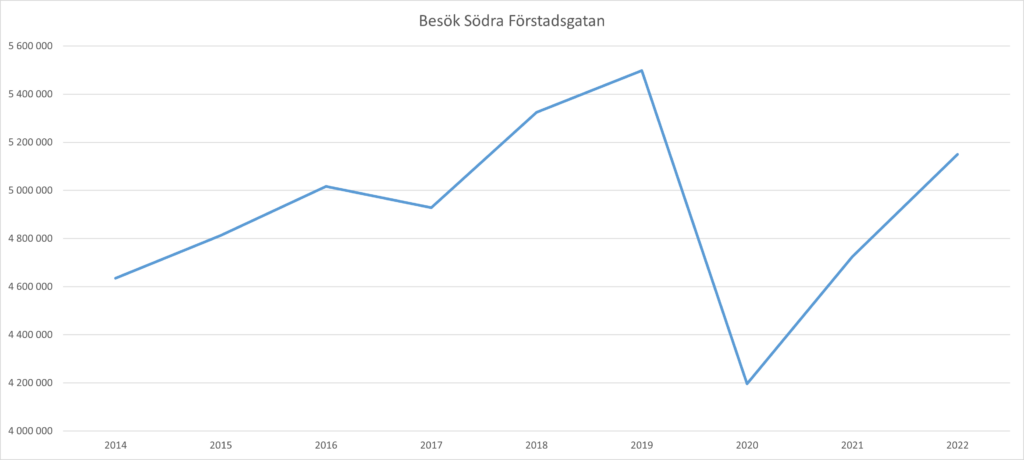

Our other main street, Södra Förstadsgatan, was condemned by many in the early 2010s. The graph below shows how we managed to turn this around. Between 2015 and 2019, the flow of visitors increased by an average of a stable 3.5 % per year from having previously lost visitors dramatically. Corona was a severe blow to the street, which had regained momentum and confidence in the future. As early as 2021, there was a strong recovery, which was earlier than the rest of the country. So far this year, visitor flows have been 10.5% below 2019 levels, compared to the national average of

-16.1 % for those cities that have the same visitor counting system as us.

Attractiveness/supplier mix

Objective: Improve attractiveness and supply mix

Area 1:

In the long term, the surveys we carry out every four years with Reteam show that the supply in the area is changing significantly. The most dramatic changes in supply are that the number of fashion stores has halved, from 69 in 2014 to 35 today. At the same time, the café and restaurant category has increased from 30 to 50 units. Cosmetics/hair/grooming has increased from 28 to 40 units. This can be explained by a general shift in consumption from infrequent purchases to experiences. The share of "local" businesses has also increased significantly from 29 % to 44 %, at the expense of national and international chains. This is in line with the positioning of the street as new establishments are carefully selected. Low market approach businesses have fallen from 7 % in 2014 to 2 % in 2022, which means that the visitor perceives more attractive and distinct businesses.

Area 2:

Over time, the supply mix in zone 2 has not changed as dramatically as in zone 1 since 2014. However, the number of vacant premises has increased from 23 to 33, which is due to the fact that they are large and on several levels, which are not in sufficient demand with the structural transformation that is taking place. Here, property owners are working to adapt the premises and have also been very successful with the establishments that have taken place. This can be seen, for example, in the fact that businesses with a "high market approach" have increased from 7 % to as much as 15 % in the zone, while the "low market approach" has decreased from 13 % to 3 %. The establishments in the area are of high quality and bode well for the future attractiveness of the area.

Area 3:

As in zone 1, zone 3 has lost in fashion and gained further in cosmetics/hair/care since 2014, the proportion of businesses in this category in the zone is high 29 %. There were 30 fashion stores in 2014 but only 20 fashion stores in the area today. The proportion of cafes and restaurants is high 28 % in the zone, but has remained high since 2014 and the zone is known for a good food offer. A positive change is that the zone had a high proportion of businesses with a "low market approach" in 2014, as many as 17 %. In the 2022 survey, the proportion was down to 5 %, a clear improvement. The area has long had a high share of "local" businesses. Now that proportion is higher than ever, a full 97 % of businesses are local, only 3 % are national chains. This fits well with the Escape Mainstream positioning as it is easier for local businesses/non-chains to offer a unique offering.

Area 4:

Apart from a large outlet unit at Kv Caroli, fashion stores have almost completely disappeared from area 4. In 2014, there were 17 fashion stores in the area, now according to Reteam's survey there are only 4 left. Even in this area, there is instead an increase in units in the cosmetics / hair / care category, from 37 to 46.

Consumer survey 2022

The consumer survey carried out in the autumn and published in January 2023 provides the following summaries:

- Around 6 out of 10 people in Malmö visit Malmö City for shopping/culture/food/entertainment/drinks every week. The corresponding figure among residents in the neighbouring municipalities is 2 out of 10.

- The most pleasant place to shop in the Malmö region for restaurants/cafés and bars is without competition Malmö City, both among Malmö residents and others.

- The most pleasant place to shop is also Malmö City, followed by Emporia, both among Malmö residents and among residents of other municipalities. Mobilia comes third among residents of Malmö and Lund comes third among residents of the neighbouring municipalities.

- Area 1: Södra Pedestrian Street is good because there is a lot gathered in one place, a good mix of shops and cafés.

- Area 2: The northern part is nice, neat, pleasant and cosy.

- Area 3: People are satisfied with the Davidshall area because it is cosy, nice houses, pleasant environment and quiet.

- Area 4: Those who are satisfied with Caroli perceive it as a quiet place, but this is also what makes people negative about the place, that a lot has been done and that it feels dead.

- The uniqueness of Malmö City is that it is multicultural and diverse where old meets new and there are many parks. What's also unique is that everything is available and that it's close to everything. It feels both modern and cosy and is close to the sea. The restaurants and people are also something that is perceived as unique to Malmö City.

The survey will form the basis for further work and will be repeated at least every three years.

Local business development

Objective: Positive development of the local business community according to Cityindex and Malmöläget

Cityindex:

Cityindex 2019-2020: Malmö City retained a larger share of its turnover than other comparable cities.

Cityindex 2020-2021: Malmö City had a total turnover development of +10.3% (compared to 9.9% for all city centres). The indexed turnover growth for 2018-2021 is 93, which is better than both comparable city centres (88) and all city centres (91). The city centre's average purchase growth in 2020-2021 increased by 17.11 p.p.3T, which is higher than other comparable cities. Malmö's city centre accounts for 21 % of the municipality's total retail turnover. This is a higher share than for comparable cities.

Malmöläget:

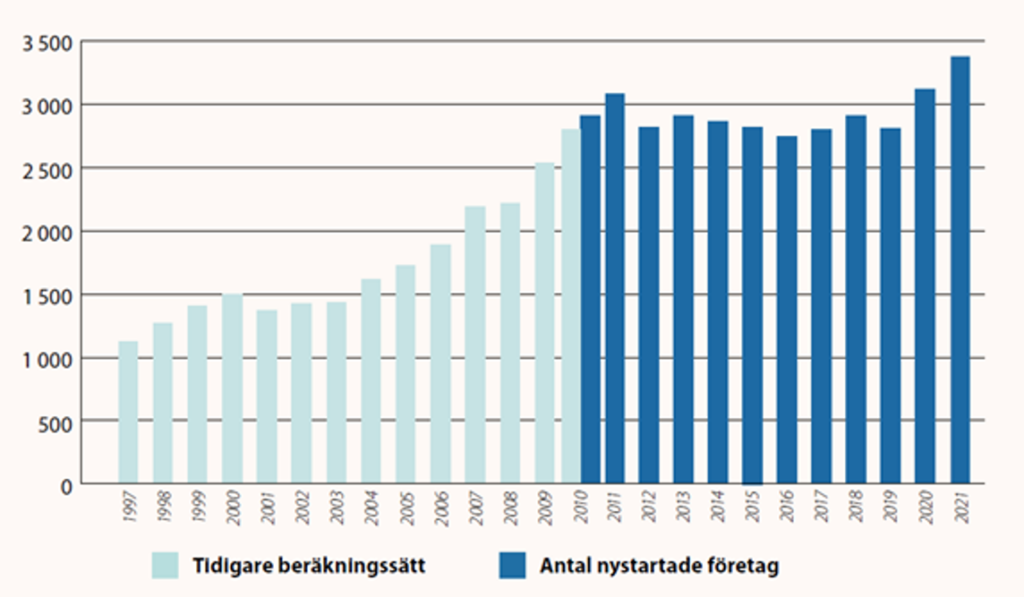

Number of start-ups

In 2021, 3382 new enterprises were started, which is an increase of 8.71 FTEs from the previous year (6.81 FTEs in Sweden). There were 9 businesses started in Malmö every day in 2021. The number of bankruptcies was 348, which is a decrease of 21% from the previous year.

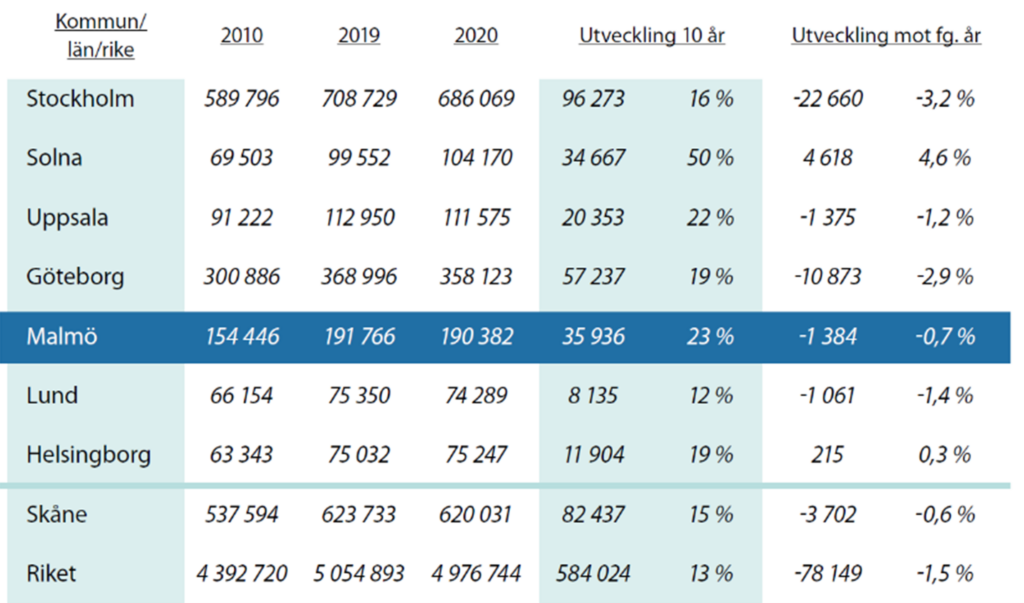

Development of the labour force

Over the last 10 years, there has been a very positive development in the number of people in employment with a workplace in Malmö - an increase of 231 FTEs. This compares with Sweden at 131 FTEs, Stockholm at 161 FTEs and Gothenburg at 191 FTEs. The slight decrease of 0.7% from 2020 to 2021 can be attributed to the effects of the pandemic.

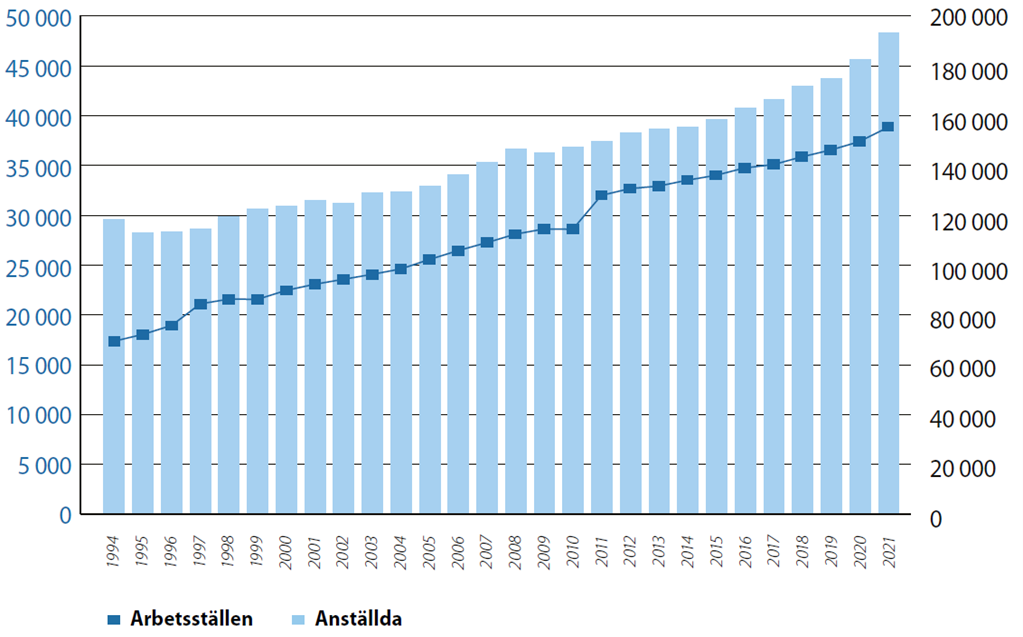

Development of number of workplaces and employees

Many new companies are starting up and established companies are choosing to locate their operations in Malmö. The number of workplaces has increased significantly and today's business structure consists largely of small and medium-sized enterprises. In 2021, Malmö had 193,642 employees spread across 39,107 workplaces. The number of employees has increased by 421 FTEs in 15 years and the number of establishments has increased by 471 FTEs in 15 years. The trend is clear - the local economy is developing favourably.

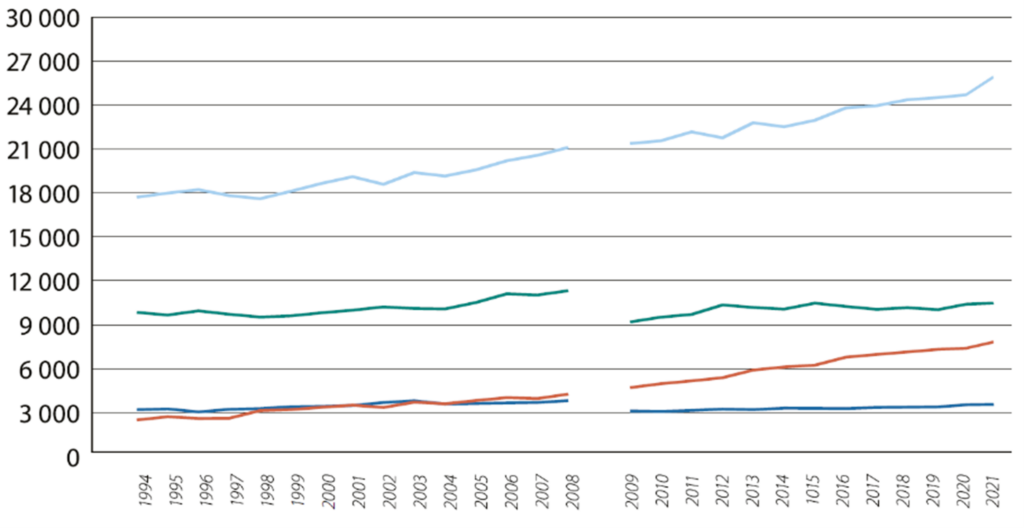

Number of employees in Malmö, by sector

Among industries, trade (light blue line) and hotels and restaurants (orange line) stand out in particular. The Trade sector accounts for 13% of the labour force (compared to 12% in Sweden) and is ranked 3rd in Malmö after Business Services and Health Care and Social Assistance.

The hospitality industry

The recovery has been strong and is almost at pre-pandemic levels. Both accommodation revenue/occupied room and occupancy rates have also increased.

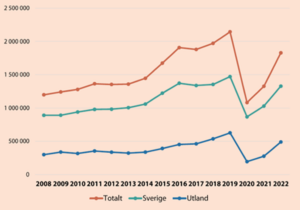

Preliminary figures for the full year 2022 show that 1,950,903 guest nights were spent during the year, which represents an increase of 47.21 FTEs compared to 2021.

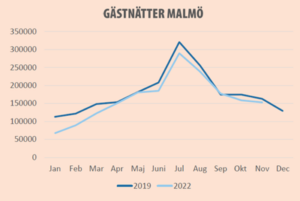

The tourism industry in Malmö has shown a positive trend for several years. The growth curve for commercial guest nights has remained stable. The supply has grown as new facilities, attractions and hotels have been established, and since 2010 the number of hotel rooms has increased by 46%. 2020 was a turning point as commercial guest nights in Malmö halved compared to 2019. A cautious recovery took place in 2021 when a total of 1 325 673 commercial guest nights were recorded - an increase of 22.6% compared to 2020, but still a large drop in volume compared to 2019 when Malmö had 2 143 238 commercial guest nights. The first graph below shows the development per full year (except 2022 which is accumulated until November) and the second graph compares 2019 with 2022.

Urban environment

Goal: An improved urban environment according to the Malmö Stad City Report

The report shows an increase from 67% (2020) to 71% (2022) on the question "Malmö city centre is attractive to visit".

The Talk Dirty campaign resulted in an increase in bin use of 398% - which continued even after the campaign ended. The campaign made world news, attracting the attention of 140 international media outlets (and an organic social media reach of 563 million with 130 000 interactions!)

Malmö City Gift Card

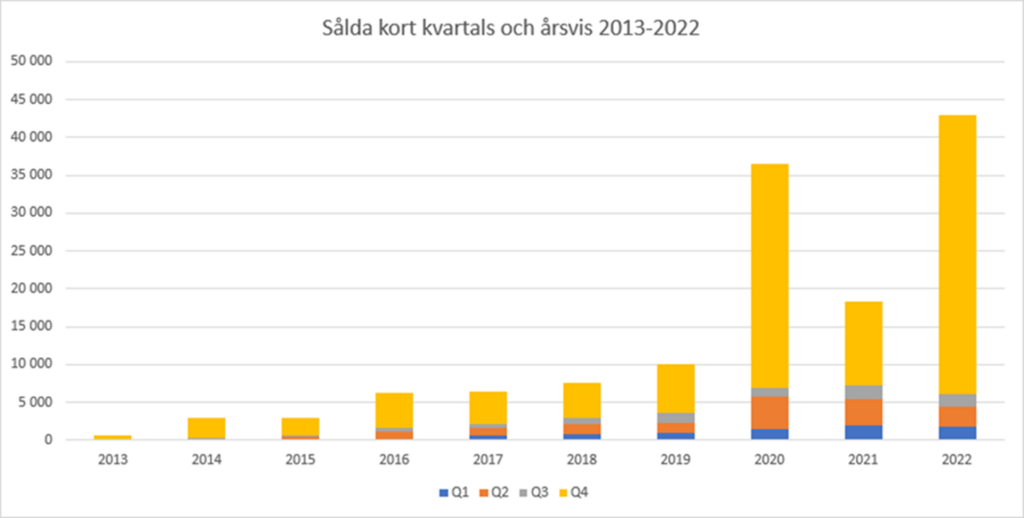

The development of the number of Malmö City Gift Cards sold is shown below. Gift card sales have increased by an average of 39.4 per cent per year since the first full year of 2014. The chart shows targets and outcomes over the years.

2018: Target: 3 400 000. Outcome: SEK 3 454 877

2019: Target: 4 100 000. Outcome: SEK 4 358 756

2020: Target: 5 200 000. Outcome: 19 070 227 kr

2021: Target: 7,000,000 (increase based on 2019 as the last normal year). Outcome: 12 904 429 kr

2022: Target: SEK 8 000 000. Outcome: SEK 18 508 048

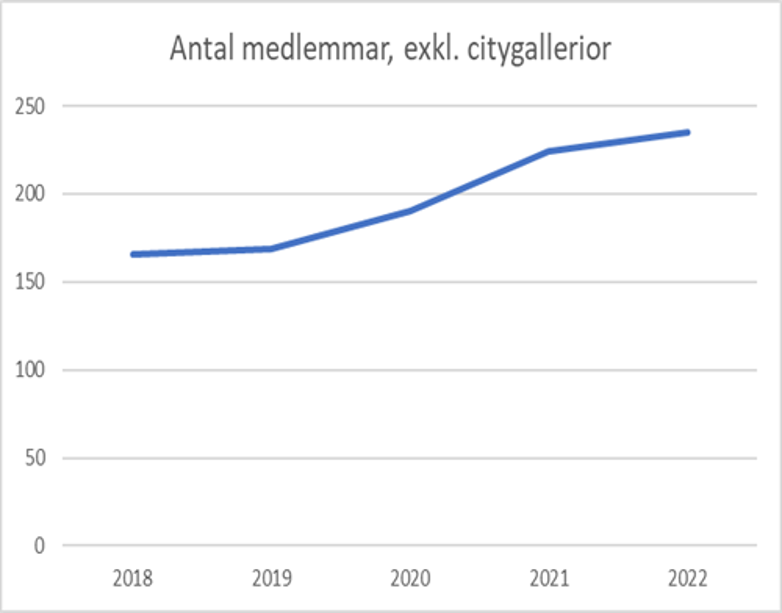

Number of members

Number of members (excluding city shopping centres, just over 200 businesses. These are automatically recruited through the respective property owners who pay the business's membership fee and are thus not an influential factor in recruitment efforts).

In 2022, MCS had 458 members in the category Trade & Other Business (including city centres), which is an all-time high.

2018 2019 2020 2021 2022

166 169 190 224 235

Internal and external communication

Social media followers

Increase the number of followers on Instagram and Facebook.

2022 compared to 2021:

Facebook

41 % increased the number of visitors to our Facebook page by 5,478.

In total, we currently have 35 602 followers (15 Feb 2023).

335,445 accounts have been reached on facebook which is an increase of 183 %.

Instagram

24 % increased its number of new followers on Instagram by 3,131.

In total, we currently have 15 963 followers (15 Feb 2023).

489,673 accounts have been reached on Instagram which is an increase of 167 %.

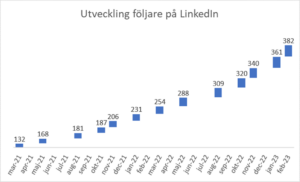

LinkedIn

524 % increased page views on LinkedIn, which is 343 views.

928 % increased our unique visitors on LinkedIn which is 185 visitors.

While Facebook has been fairly stagnant in terms of followers, Malmö City's two other channels have developed very well and increased the number of followers significantly.

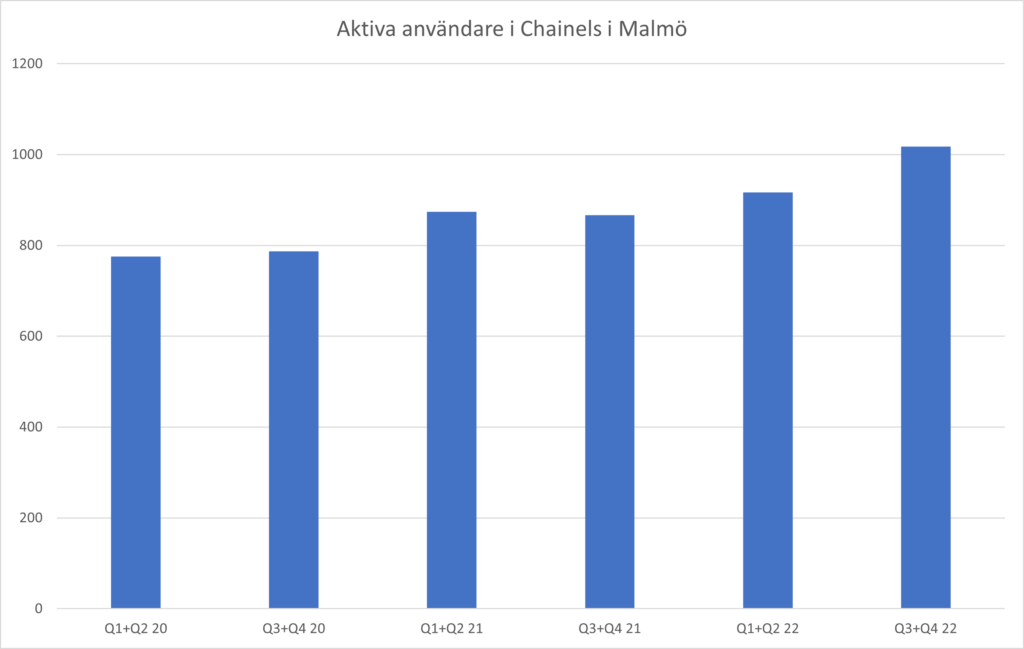

Number of active users in Chainels

Chainels was launched in September 2019 and currently there are 1071 businesses in the system with 1371 users. The number of active users has increased every six months since the launch, from less than 800 per six months to over 1000. Activity continues to increase; over 800 people have been active in the last 30 days.

Reconciliation of members

Every year, we conduct a member survey to get feedback on our efforts and to gather suggestions for future co-operation.

53% responded that they were better/much better off in December 2022 compared to December 2021. 65% responded that they were better off in 2022 than in 2021.

When members are asked to rate (1-5) how they think Malmö Citysamverkan's initiatives have affected the city centre and their business in 2022, the bars that predominantly give 4 and 5 are:

MCS social media in general, news update in Chainels, weekly newsletters every Friday, the member meetings, Stora Mediedagen, training Future Consumer, visitor statistics, No Pulse Without Yours, Malmö City Gift Card (both received and marketing), International Food Festival, Malmö City Awards and 25th anniversary, Christmas lights (curtains and installations), Christmas calendar and Christmas market.

When asked how MCS can help their business in 2023, most choose:

Promotion of the city centre and its offer, communication - newsletters, influencing the municipality (politicians), decoration in the urban environment, membership meetings/breakfast meetings, training/webinars, Christmas lights and Christmas market.

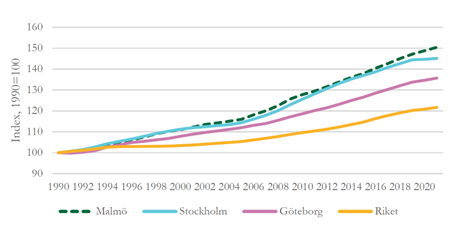

Population growth and housing

Malmö is the fastest growing metropolis. The graph shows the growth rate of the population of the three metropolitan areas and Sweden as a whole since 1990 as an index. Malmö's value for 2021 is 150, which means that Malmö's population was 50 per cent larger at the end of 2021 compared to the end of 1990.

Of the 26,750 homes that Malmö has committed to building as part of the Urban Package, 14,054 have already been completed. The dashed line shows the average number of dwellings per year until the end of the project in 2035, and the solid line shows that the number of completed dwellings is well above that.